Preview attachment YS7443.jpgYS7443.jpg421 KB

This blog follows the US stock market daily. Free market news, market comments, stock charts, stock and options buy/sell suggestions are provided throughout the day.

Sunday, September 29, 2019

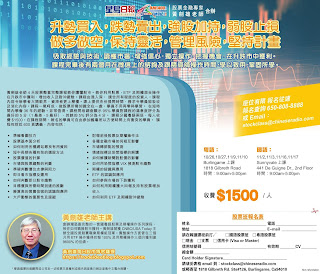

4天完整股票课程10月底在旧金山开课

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Friday, September 27, 2019

Weak Technology Stocks Are Stock Market's Drag 科技股疲软是股市的拖累

The changing US-China trade news is the key for market direction. Investors are reacting to every piece of trade news and have been driving the stock market up or down violently. Today, Bloomberg News reported Trump administration officials are considering delisting Chinese companies from American stock exchanges and putting a limit on U.S. government pension funds’ exposure to the Chinese market, although the discussion is in its preliminary stages. This is seen as Trump administration is increasing pressure on China to come to terms on a trade deal. On the news, US listed Chinese stocks such as BABA, JD, SINA, TCEHY are down nearly 5% on average. The news turned Dow's earlier 121 point rise to a 98 point down now. The damage is more than 3 times larger in the technology concentrated Nasdaq Composite index as it is down more than 1%. Micron Technology's (MU -10.43%) less satisfactory earning report and weaker than expected outlook is a drag. Technically, the Nasdaq Composite is in trouble as it dropped below its 20 and 50 day moving average supports and also traced out a bearish 5 month Head and Shoulder Top pattern. Tech sectors such as semiconductor SMH, software IGV, internet FDN, social media SOCL and FAANG stocks are all weak. Nasdaq Composite looks trending towards its 200 day moving average support at 7695, while it's 50 day moving average at 8040 is its resistance.

中美贸易新闻的变化是市场走向的关键。投资者对每一则贸易新闻都做出反应,并一直在猛烈推动股市上涨或下跌。今天,《彭博新闻》报道,特朗普政府官员正在考虑将中国公司从美国证券交易所退市,并限制美国政府养老基金投资在中国市场,尽管讨论尚处于初步阶段。这被视为特朗普政府对中国在达成贸易协议方面施压。受此消息影响,在美国上市的中国股票,如BABA,JD,SINA及TCEHY平均下跌近5%。这一消息使道琼斯指数从早先的121点上升到现在的下跌98点。科技股集中的纳斯达克综合指数今天跌幅超过1%,损失要比道指大3倍以上。美光科技(MU -10.43%)的业绩报告不尽如人意且前景展望低于预期是个拖累。从技术上讲,纳斯达克综合指数已造成了相当的破坏,因为它跌破了20天和50天移动平均线的支撑位,并且还造成了看跌的5个月头肩顶形态。半导体SMH,软件IGV,互联网FDN,社交媒体SOCL和FAANG股票等科技板块均疲弱。纳斯达克综合指数看似会跌向200日移动平均线支撑位7695,而其50日移动平均线8080则是上行的阻力位。

中美贸易新闻的变化是市场走向的关键。投资者对每一则贸易新闻都做出反应,并一直在猛烈推动股市上涨或下跌。今天,《彭博新闻》报道,特朗普政府官员正在考虑将中国公司从美国证券交易所退市,并限制美国政府养老基金投资在中国市场,尽管讨论尚处于初步阶段。这被视为特朗普政府对中国在达成贸易协议方面施压。受此消息影响,在美国上市的中国股票,如BABA,JD,SINA及TCEHY平均下跌近5%。这一消息使道琼斯指数从早先的121点上升到现在的下跌98点。科技股集中的纳斯达克综合指数今天跌幅超过1%,损失要比道指大3倍以上。美光科技(MU -10.43%)的业绩报告不尽如人意且前景展望低于预期是个拖累。从技术上讲,纳斯达克综合指数已造成了相当的破坏,因为它跌破了20天和50天移动平均线的支撑位,并且还造成了看跌的5个月头肩顶形态。半导体SMH,软件IGV,互联网FDN,社交媒体SOCL和FAANG股票等科技板块均疲弱。纳斯达克综合指数看似会跌向200日移动平均线支撑位7695,而其50日移动平均线8080则是上行的阻力位。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Tuesday, September 24, 2019

Today Is A Downside Reversal Day 今天是反转下跌日

Major US stock indices have erased their morning gain and turned negative. Today is likely be a downside reversal day for the market and likely trending down the whole day. The market reversal came about after Donald Trump speech in United Nations which strongly criticizing China. These criticism are not helping the coming trade talk in 2 weeks. Major market indexes are further away from their all time highs and are more likely forming bearish Double Top patterns. Rising VIX (Fear Gauge) ,TLT (20 year treasury) and GLD, SLV (precious metals) , continue falling FNGU (FANG+stocks) and EWG (Germany stock ETF) are all showing investors concern. It is prudent to increase the hedge for the market downside now. Some ideas to profit from the market market down turn are: Long TVIX, FNGD, SQQQ, GLD, SLV and short SMH, BYND, ROKU.

These are what Trump said in the United Nations this morning :

.Trump once again stresses that he won't accept a "bad deal" in trade negotiations with China.

.He accused the world's second-largest economy of gaming the World Trade Organization after it was admitted as a member in 2001.

.China hasn't adopted promised reforms.

.China uses heavy stae subsidies, steals IP.

.He met with Micron CEO, heard of IP theft in China.

.World expects Beijing to honor treaty on Hong Kong.

美国主要股指已经抹去了早盘涨幅并转正为负。 对于市场来说,今天可能是个下行逆转日,并且可能整天都会下跌。 市场逆转是在唐纳德·特朗普在联合国发表强烈批评中国的讲话之后发生的。 这些批评对两周后的贸易谈判毫无帮助。 主要市场指数现在距离其历史高点更远,并且更有可能形成看跌的双顶形态。上升的VIX(恐慌指标),TLT(20年期国债)和GLD,SLV(贵金属),持续下跌的FNGU (FANG+股票)及EWG(德国股票ETF)都显示出投资者的担忧。现在是考虑加码对冲市场下行风险的时候了。 从市场下跌获利的一些想法是:买TVIX,SQQQ,FNGD, GLD, SLV和空SMH,BYND,ROKU。

下面是特朗普今天上午在联合国说的话:

。特朗普再次强调,他不会接受与中国的贸易的“坏协议”。

。他指责世界第二大经济体在2001年被接纳为WTO成员后在玩弄WTO。

。中国尚未实行承诺的改革。

。中国使用高额补贴,盗用知识产权。

。他曾会见美光公司首席执行官,听说过中国的IP盗窃。

。世界希望北京履行对香港的条约。

These are what Trump said in the United Nations this morning :

.Trump once again stresses that he won't accept a "bad deal" in trade negotiations with China.

.He accused the world's second-largest economy of gaming the World Trade Organization after it was admitted as a member in 2001.

.China hasn't adopted promised reforms.

.China uses heavy stae subsidies, steals IP.

.He met with Micron CEO, heard of IP theft in China.

.World expects Beijing to honor treaty on Hong Kong.

美国主要股指已经抹去了早盘涨幅并转正为负。 对于市场来说,今天可能是个下行逆转日,并且可能整天都会下跌。 市场逆转是在唐纳德·特朗普在联合国发表强烈批评中国的讲话之后发生的。 这些批评对两周后的贸易谈判毫无帮助。 主要市场指数现在距离其历史高点更远,并且更有可能形成看跌的双顶形态。上升的VIX(恐慌指标),TLT(20年期国债)和GLD,SLV(贵金属),持续下跌的FNGU (FANG+股票)及EWG(德国股票ETF)都显示出投资者的担忧。现在是考虑加码对冲市场下行风险的时候了。 从市场下跌获利的一些想法是:买TVIX,SQQQ,FNGD, GLD, SLV和空SMH,BYND,ROKU。

下面是特朗普今天上午在联合国说的话:

。特朗普再次强调,他不会接受与中国的贸易的“坏协议”。

。他指责世界第二大经济体在2001年被接纳为WTO成员后在玩弄WTO。

。中国尚未实行承诺的改革。

。中国使用高额补贴,盗用知识产权。

。他曾会见美光公司首席执行官,听说过中国的IP盗窃。

。世界希望北京履行对香港的条约。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Monday, September 23, 2019

Silver Is Looking Very Good 白银非常看好

Silver rallied big today by up 4.83% to $18.71 while Gold is up only 1.08% to $1531.50. Since August 1 low to today's close Gold rallied 8.4% while Silver rallied 17.4% during the same period.

One reason for better price action in Silver is the Gold and Silver Ratio has gone to extreme. During the last 20 years, when Gold and Silver ratio rose above 80 it always retreated. As a result, Silver usually rallied hard to catch up with Gold. This time this ratio rallied to an extreme level of 95 in July before falling back to 85 today. Silver has been performing much better than Gold during this period.

Since the high low average for the last 20 year is around 60, Silver has a lot of rally left to catch up.

SLV is the 1X ETF for Silver and is now trading at $17.51. On SLV's daily chart, we see it found support at $16.28 last week and started to bounce and today it rallied hard by 4.23% to $17.51. This is indicative of the correction is over and is ready to go back up to challenge previous high of $18.35. Now refer to the monthly chart, after $18.35, $20 will be the next resistance. SLV has been trading between 13 to 20 area for the last 5 years. Once it breaks out of this 5 year base, its next price target will be $27. It sure is enticing to get into SLV now.

今天白银大涨4.83%至18.71美元,而黄金仅上涨1.08%至1531.50美元。 从八月1日低点到今天收盘,同期黄金上涨了8.4%,白银却上涨了17.4%。白银价格走势较好的原因之一是黄金和白银比率已达到极限。 在过去的20年中,当黄金和白银的价格比率上升到80以上时,它总是会回落。 结果是白银通常会大涨以追赶黄金。 这次,该比率在7月时升至95的极端水平,然后回落至今天的85。 在此期间,白银的表现好于黄金。由于过去20年黄金和白银比率的高低平均水平大约为60,因此白银还有很大的空间可以追涨。

SLV是跟踪白银的1X ETF,目前交易价为17.51美元。 在SLV的日线图上,我们看到它在上周找到支撑位16.28美元后开始反弹,今天它强劲上涨了4.23%至17.51美元。 这显示下跌修正已经结束,并准备回到之前的高点18.35美元。 月线图上显示,在18.35美元之后,20美元将是下一个阻力位。 在过去的5年中,SLV的交易区间在13到20之间。 一旦它突破这5年的区间,坚实的底部将造成,其下一个目标价将是27美元。 无疑,现在SLV的价位是非常吸引而是个买入的好时机。

One reason for better price action in Silver is the Gold and Silver Ratio has gone to extreme. During the last 20 years, when Gold and Silver ratio rose above 80 it always retreated. As a result, Silver usually rallied hard to catch up with Gold. This time this ratio rallied to an extreme level of 95 in July before falling back to 85 today. Silver has been performing much better than Gold during this period.

Since the high low average for the last 20 year is around 60, Silver has a lot of rally left to catch up.

SLV is the 1X ETF for Silver and is now trading at $17.51. On SLV's daily chart, we see it found support at $16.28 last week and started to bounce and today it rallied hard by 4.23% to $17.51. This is indicative of the correction is over and is ready to go back up to challenge previous high of $18.35. Now refer to the monthly chart, after $18.35, $20 will be the next resistance. SLV has been trading between 13 to 20 area for the last 5 years. Once it breaks out of this 5 year base, its next price target will be $27. It sure is enticing to get into SLV now.

今天白银大涨4.83%至18.71美元,而黄金仅上涨1.08%至1531.50美元。 从八月1日低点到今天收盘,同期黄金上涨了8.4%,白银却上涨了17.4%。白银价格走势较好的原因之一是黄金和白银比率已达到极限。 在过去的20年中,当黄金和白银的价格比率上升到80以上时,它总是会回落。 结果是白银通常会大涨以追赶黄金。 这次,该比率在7月时升至95的极端水平,然后回落至今天的85。 在此期间,白银的表现好于黄金。由于过去20年黄金和白银比率的高低平均水平大约为60,因此白银还有很大的空间可以追涨。

SLV是跟踪白银的1X ETF,目前交易价为17.51美元。 在SLV的日线图上,我们看到它在上周找到支撑位16.28美元后开始反弹,今天它强劲上涨了4.23%至17.51美元。 这显示下跌修正已经结束,并准备回到之前的高点18.35美元。 月线图上显示,在18.35美元之后,20美元将是下一个阻力位。 在过去的5年中,SLV的交易区间在13到20之间。 一旦它突破这5年的区间,坚实的底部将造成,其下一个目标价将是27美元。 无疑,现在SLV的价位是非常吸引而是个买入的好时机。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Tuesday, September 17, 2019

A Biotech Stock Full Of Upside Momentum 一只充满上升动力的生物技术股

Aclaris Therapeutics, Inc., (ACRS 2.02 +0.99) a biopharmaceutical company, focuses on identifying, developing, and commercializing various therapies for dermatological and immuno-inflammatory diseases in the United States.

。Company announced positive results from its Phase 3 clinical trial, THWART-2 (WART-302), of A-101 45% Topical Solution (A-101 45% Topical Solution), an investigational new drug for the treatment of common warts (verruca vulgaris). A-101 45% Topical Solution met the primary and all secondary efficacy endpoints, achieving clinically and statistically significant clearance of common warts. A-101 45% Topical Solution is a proprietary high-concentration hydrogen peroxide topical solution being developed as a potential prescription treatment for common warts. If approved, A-101 45% Topical Solution would be the first FDA approved prescription treatment for common warts. An estimated 22 million Americans each year have common warts problems.

。In July company says that its Phase 2 trial of ATI-501 oral in patients with Alopecia Areata met its primary endpoint. The treatment reached statistically significant improvement over placebo on several hair growth measures.

。Today's stock is up over 80% and trading volume is 22 times average volume, a show of tremendous upside momentum.

。Bullish 3-month Island Reversal Up Pattern, broke above 20 and 50 day moving averages, trend is up. Next resistance is 3, may fill gap to 4.32 if break above 3.

。4 analysts rate stock at Strong Buy and 2 Buy, no Sell. Average price target 3.83. 52 week price range 0.74 to 16.07.

。Book Value 3.32, Cash Per Share 2.66.

Aclaris Therapeutics,Inc。(ACRS)是一家生物制药公司,专注于识别,开发和商业化美国皮肤病和免疫炎症疾病的各种疗法。

。昨日公司宣布其第3期临床试验THWART-2(WART-302),A-101 45%局部用药(A-101 45%局部用药),一种用于治疗常见疣( verruca vulgaris)的研究性新药有阳性结果。 A-101 45%外用溶液符合主要和所有次要疗效终点,实现临床和统计学上显着的清除常见疣。 A-101 45%外用溶液是一种专利的高浓度过氧化氢外用溶液,正在开发作为常见疣的潜在处方药。如果获得批准,A-101 45%外用溶液将成为FDA首个被批准的常见疣处方药。估计每年有2200万美国人患有常见的疣。

。7月份公司表示其ATI-501斑秃(Alopecia Areata)患者口服ATI-501的2期试验符合其主要终点。 该公司表示,该治疗在几项头发生长方面均优于安慰剂(Placebo)。

。今日股价上涨超过80%,成交量是平均成交量的22倍,表现出巨大的上涨势头。

。看涨的 3个月的岛形反转上行模式并且突破了20日和50日移动均线,趋势上升。下一阻力为3,如果突破3以上可填补缺口至4.32。

。4位分析师评级为强买入和2位买入,无卖出的股票评级。综合目标价3.83。 52周价格区间为0.74至16.07。

。账面价值3.32,每股现金2.66。

。Company announced positive results from its Phase 3 clinical trial, THWART-2 (WART-302), of A-101 45% Topical Solution (A-101 45% Topical Solution), an investigational new drug for the treatment of common warts (verruca vulgaris). A-101 45% Topical Solution met the primary and all secondary efficacy endpoints, achieving clinically and statistically significant clearance of common warts. A-101 45% Topical Solution is a proprietary high-concentration hydrogen peroxide topical solution being developed as a potential prescription treatment for common warts. If approved, A-101 45% Topical Solution would be the first FDA approved prescription treatment for common warts. An estimated 22 million Americans each year have common warts problems.

。In July company says that its Phase 2 trial of ATI-501 oral in patients with Alopecia Areata met its primary endpoint. The treatment reached statistically significant improvement over placebo on several hair growth measures.

。Today's stock is up over 80% and trading volume is 22 times average volume, a show of tremendous upside momentum.

。Bullish 3-month Island Reversal Up Pattern, broke above 20 and 50 day moving averages, trend is up. Next resistance is 3, may fill gap to 4.32 if break above 3.

。4 analysts rate stock at Strong Buy and 2 Buy, no Sell. Average price target 3.83. 52 week price range 0.74 to 16.07.

。Book Value 3.32, Cash Per Share 2.66.

Aclaris Therapeutics,Inc。(ACRS)是一家生物制药公司,专注于识别,开发和商业化美国皮肤病和免疫炎症疾病的各种疗法。

。昨日公司宣布其第3期临床试验THWART-2(WART-302),A-101 45%局部用药(A-101 45%局部用药),一种用于治疗常见疣( verruca vulgaris)的研究性新药有阳性结果。 A-101 45%外用溶液符合主要和所有次要疗效终点,实现临床和统计学上显着的清除常见疣。 A-101 45%外用溶液是一种专利的高浓度过氧化氢外用溶液,正在开发作为常见疣的潜在处方药。如果获得批准,A-101 45%外用溶液将成为FDA首个被批准的常见疣处方药。估计每年有2200万美国人患有常见的疣。

。7月份公司表示其ATI-501斑秃(Alopecia Areata)患者口服ATI-501的2期试验符合其主要终点。 该公司表示,该治疗在几项头发生长方面均优于安慰剂(Placebo)。

。今日股价上涨超过80%,成交量是平均成交量的22倍,表现出巨大的上涨势头。

。看涨的 3个月的岛形反转上行模式并且突破了20日和50日移动均线,趋势上升。下一阻力为3,如果突破3以上可填补缺口至4.32。

。4位分析师评级为强买入和2位买入,无卖出的股票评级。综合目标价3.83。 52周价格区间为0.74至16.07。

。账面价值3.32,每股现金2.66。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Monday, September 16, 2019

Chance Of Stock Market Making New High May Have Lost 股市创造新高的机会可能已经失去

After Saturday's attack on Saudi's second-biggest oil field in Khurais, US WTI crude prices surged nearly 15%, the largest one day move in history. Oil and gas exploration 3X ETF GUSH is up nearly 32%. Oil traders obviously seeing more troubles to come in the Middle East. (The latest news:American intelligence indicates that the attack on a major Saudi oil facility originated in Iran, three people familiar with the intelligence told NBC News — an assessment that is likely to escalate tensions between Washington and Tehran.) The troubles ahead may be it may take a longer time to repair the refinery's damage and US and Saudi may decide to strike Iran. Interruption on global oil supply and heighten geographic risk are the worries.

Meanwhile, China's economy slowed further in August, indicating current stimulus policies may not be enough to shield the economy from the worsening effects of the trade war with the US. China's Industrial output rose 4.4% from a year earlier, versus a median estimate of 5.2%. Retail sales Expanded 7.5%, compared to a projected 7.9% increase. Fixed-asset investment slowed to 5.5% in the first eight months, versus a forecast 5.7%.

However, the strange thing is especially calm as major US stock market indexes are down only less than 0.4% on average, and they are only a little over 1% from their all time highs. Why is the complacency? May be investors like the fact that interest rate is low worldwide as most world's central banks are lowering their interest rate. But all these central bank easing are well known and have been reflected in the market. One explanation is that equity fund capitals have no where to go since their prospectus required them to buy stock regardless of risk. Another possibility is investors underestimating the impact of the Saudi oil refinery attack.

Stock market's behavior is hard to fathom at times. But I think the risk and reward is not suitable to chase the market higher and would be really cautious about the stock market at this juncture. The chance of stock market making all time high may have came and gone as global oil supply interrupted, geographic risk heightens, global economy slows, US/China trade war is on going, Washington is reportedly preparing to announce tariffs on billions of euros of goods from the European Union and stock price is rising as earnings deteriorate. There are too many negatives out there, the present stable stock market may just be calm before the storm. It may not be a bad idea to consider to buy TVIX, GUSH and NUGT for profits.

周六袭击沙特在Khurais的第二大油田后,美国WTI原油价格均飙升近15%,这是历史上最大的一天涨幅。原油及天然气开发板块3X ETF GUSH上涨近32%。石油炒家显然觉得中东还会有更多的麻烦。(最新消息:美国情报部门表示,袭击主要的沙特石油设施来自伊朗,三名知情人士告诉NBC新闻 - 这一评估可能会加剧华盛顿与德黑兰之间的紧张关系。)

现在市场面对的麻烦可能是需要更长的时间来修复炼油厂的损坏及美国和沙特可能会决定打击伊朗。全球石油供应中断和地域风险加剧是令人担忧的问题。

与此同时,中国经济在8月进一步放缓,表明当前的刺激政策可能不足以保护经济免受与美国贸易战的恶化影响。中国工业产出较上年同期增长4.4%,而中位数估计为5.2%。零售额增长7.5%,预计增长7.9%。固定资产投资在今年前八个月放缓至5.5%,而预测为5.7%。

然而,奇怪的是美股表现特别平静,美国主要股票指数平均只下跌0.4%,而且距离历史最高点只有1%多一点。为什么乐观?可能是投资者喜见球利率低的事实,因为大多数世界各国央行都在降低利率。但所有这些央行的宽松政策都是众所周知的,并已反映在市场中。一个解释是股票基金资本无处可去,因为他们的招股说明书要求他们一定要购买股票而不管风险如何。另一种可能是投资者低估了沙特炼油厂袭击的影响。

股市的行为有时难以理解。但我会非常谨慎,觉得在这个时刻追逐高涨的市场的风险与回报 不合适。随着全球石油供应中断,地域风险加剧,全球经济放缓,美国/中国贸易战正在进行,华盛顿据报导准备宣布对数十亿欧元商品征收关税,企业收益恶化而股价却上涨,这些负面因素显示股票市场创出历史新高的机会可能已得而复失。目前股市的稳定可能只是风暴来临之前的平静。考虑参与TVIX,GUSH和NUGT获取利润可能不是坏主意。

Meanwhile, China's economy slowed further in August, indicating current stimulus policies may not be enough to shield the economy from the worsening effects of the trade war with the US. China's Industrial output rose 4.4% from a year earlier, versus a median estimate of 5.2%. Retail sales Expanded 7.5%, compared to a projected 7.9% increase. Fixed-asset investment slowed to 5.5% in the first eight months, versus a forecast 5.7%.

However, the strange thing is especially calm as major US stock market indexes are down only less than 0.4% on average, and they are only a little over 1% from their all time highs. Why is the complacency? May be investors like the fact that interest rate is low worldwide as most world's central banks are lowering their interest rate. But all these central bank easing are well known and have been reflected in the market. One explanation is that equity fund capitals have no where to go since their prospectus required them to buy stock regardless of risk. Another possibility is investors underestimating the impact of the Saudi oil refinery attack.

Stock market's behavior is hard to fathom at times. But I think the risk and reward is not suitable to chase the market higher and would be really cautious about the stock market at this juncture. The chance of stock market making all time high may have came and gone as global oil supply interrupted, geographic risk heightens, global economy slows, US/China trade war is on going, Washington is reportedly preparing to announce tariffs on billions of euros of goods from the European Union and stock price is rising as earnings deteriorate. There are too many negatives out there, the present stable stock market may just be calm before the storm. It may not be a bad idea to consider to buy TVIX, GUSH and NUGT for profits.

周六袭击沙特在Khurais的第二大油田后,美国WTI原油价格均飙升近15%,这是历史上最大的一天涨幅。原油及天然气开发板块3X ETF GUSH上涨近32%。石油炒家显然觉得中东还会有更多的麻烦。(最新消息:美国情报部门表示,袭击主要的沙特石油设施来自伊朗,三名知情人士告诉NBC新闻 - 这一评估可能会加剧华盛顿与德黑兰之间的紧张关系。)

现在市场面对的麻烦可能是需要更长的时间来修复炼油厂的损坏及美国和沙特可能会决定打击伊朗。全球石油供应中断和地域风险加剧是令人担忧的问题。

与此同时,中国经济在8月进一步放缓,表明当前的刺激政策可能不足以保护经济免受与美国贸易战的恶化影响。中国工业产出较上年同期增长4.4%,而中位数估计为5.2%。零售额增长7.5%,预计增长7.9%。固定资产投资在今年前八个月放缓至5.5%,而预测为5.7%。

然而,奇怪的是美股表现特别平静,美国主要股票指数平均只下跌0.4%,而且距离历史最高点只有1%多一点。为什么乐观?可能是投资者喜见球利率低的事实,因为大多数世界各国央行都在降低利率。但所有这些央行的宽松政策都是众所周知的,并已反映在市场中。一个解释是股票基金资本无处可去,因为他们的招股说明书要求他们一定要购买股票而不管风险如何。另一种可能是投资者低估了沙特炼油厂袭击的影响。

股市的行为有时难以理解。但我会非常谨慎,觉得在这个时刻追逐高涨的市场的风险与回报 不合适。随着全球石油供应中断,地域风险加剧,全球经济放缓,美国/中国贸易战正在进行,华盛顿据报导准备宣布对数十亿欧元商品征收关税,企业收益恶化而股价却上涨,这些负面因素显示股票市场创出历史新高的机会可能已得而复失。目前股市的稳定可能只是风暴来临之前的平静。考虑参与TVIX,GUSH和NUGT获取利润可能不是坏主意。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Sunday, September 15, 2019

Oil Price Surging After Saudi Refinery Attack 沙特炼油厂遭袭击后油价飙升

Saudi Aramco lost about 5.7 million barrels per day of output after several unmanned aerial vehicles on Saturday struck the world's biggest crude-processing facility in Abqaiq and the kingdom's second-biggest oil field in Khurais. This cut Saudi Arabia's production by half and world supply reduces by 5% . It may take weeks to restore normal production, according to people familiar with the matter.

Trump's tweet looks ready to go to war with Iran: "The Arabian oil supply was attacked. There is reason to believe that we know the culprit, are locked and loaded depending on verification, but are waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!"

In Sunday's early future trading WTI oil price rises nearly $6/barrel.

Followings are assorted comments by analysts:

Rapid McAally, Rapidan Energy:

"Today's attack on the Abqaiq processing facility identified the most important oil bullish, stock bearish and negative global growth risks. According to reports, Aramco said it expects production to restart quickly, indicating that the damage may be light. Even if it turns out to be like this, for example The Iranian agent’s crownless shameless attack on the energy system of the Kingdom of Saudi Arabia will increase the overall geopolitical risk premium. “ In a seven-day disruption scenario, crude oil prices will soar at least $15-20 per barrel and enter a 30-day scenario. Three digits in the middle.

Greg Newman, Onyx Commodities

Expects Brent futures to open $2 per barrel up and close $7 to $10 per barrel higher on Monday. The market could see a return to $100 per barrel if the issue cannot be resolved in the short term.

Christy Malek, JP Morgan

"I'd expect a $3-$5 move in oil prices in the short term. The market has been sleep-walking in risk premium in the region, disproportionately focusing on risk to demand growth and shale oil supply." "This attack introduces a New, irreversible risk premium into the market." Expects oil to rise to $80-90 a barrel over the next three-six months as the market turns its focus to geopolitics.

Tilak Doshi, Muse & Stancil

"In the oil universe, this attack is perhaps equivalent to the 9/11 attacks ... Abqaiq is easily the world's single most important oil production and processing infrastructure site." "This puts Iran's wars-by-proxy in the region squarely in The centre of the security concerns of the Middle East." "For Asian governments, perhaps this overtakes the perennial concern about the safety of tanker traffic in the Strait of Hormuz with even more serious concerns about the impact of a direct breakout of hostilities between the Saudi alliance and Iran." "Governments throughout the Asian region will perhaps now be more supportive of the US administration's tough deposition regime on Iran." ("Asian countries are more at immediate risk because they are the big importers from Saudi Arabia, with 80 % of Saudi exports going to East Asia. )

周六被几架无人驾驶飞机袭击在Khuraiss 沙特第二大油田及世界上最大的Abqaiq原油加工厂后,沙特阿美公司每天产量损失约570万桶。这使沙特阿拉伯的原油产量减少了一半,将全球约5%的供应量从市场上撤下。据知情人士透露,恢复正常生产可能需要数周时间。特朗普推文显示可能会与伊朗开战:“沙特阿拉伯的石油供应遭到袭击。 有理由相信我们知道谁是罪魁祸首,目标已被被锁定和装载已准备就绪,只等待验证。等待听到沙特王国关于他们认为是这次袭击的原因与人,以及我们将在什么条件下进行!” 在周日的早期起货交易中,WTI原油价格上涨近6美元/桶。

以下是分析师们的评论:

Rapid McAally,Rapidan Energy:

“今天对Abqaiq加工厂的攻击确定了最重要的油价看涨,股票看跌和全球负面增长风险。据报道,Aramco表示,预计生产将迅速重启,表明损害可能很轻。即使结果是就像这样,例如,伊朗特工对沙特阿拉伯王国能源系统的无耻攻击将增加整体地缘政治风险溢价。“ 在七天的中断情况下,原油价格将飙升至少15-20美元桶,在30天的中断情况下油价会升至三位数。

Greg Newman,Onyx Commodities

布伦特原油期货周一开盘会上涨2美元而收于每桶7美元至10美元。如果问题在短期内无法解决,油价可能会回到每桶100美元。

Christy Malek,JPMorgan Chase

“我预计短期内油价将上升3到5美元间 。这个市场的风险溢价一直在下滑,不成比例地关注需求增长和页岩油供应的风险。 这次袭击给市场带来了新的,不可逆转的风险溢价。随着市场将焦点转向地缘政治,油价预计未来三到六个月将升至每桶80-90美元。”

Tilak Doshi,Muse和Stancil

“在石油世界,这次袭击可能相当于9/11袭击...... Abqaiq是世界上最重要的石油生产和加工基础设施站点。这使伊朗代理战争成为该中东安全问题的核心。对于亚洲各国政府来说,沙特联盟与伊朗之间直接敌对行动更严重的影响可能已经取代了对霍尔木兹海峡油轮运输安全的长期担忧。整个亚洲地区现在可能会更加支持美国政府对伊朗的强硬制裁措施。” (“亚洲国家风险更大因为它们是沙特阿拉伯的主要进口国,沙特阿拉伯80%的出口产品流向东亚。”)

Trump's tweet looks ready to go to war with Iran: "The Arabian oil supply was attacked. There is reason to believe that we know the culprit, are locked and loaded depending on verification, but are waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!"

In Sunday's early future trading WTI oil price rises nearly $6/barrel.

Followings are assorted comments by analysts:

Rapid McAally, Rapidan Energy:

"Today's attack on the Abqaiq processing facility identified the most important oil bullish, stock bearish and negative global growth risks. According to reports, Aramco said it expects production to restart quickly, indicating that the damage may be light. Even if it turns out to be like this, for example The Iranian agent’s crownless shameless attack on the energy system of the Kingdom of Saudi Arabia will increase the overall geopolitical risk premium. “ In a seven-day disruption scenario, crude oil prices will soar at least $15-20 per barrel and enter a 30-day scenario. Three digits in the middle.

Greg Newman, Onyx Commodities

Expects Brent futures to open $2 per barrel up and close $7 to $10 per barrel higher on Monday. The market could see a return to $100 per barrel if the issue cannot be resolved in the short term.

Christy Malek, JP Morgan

"I'd expect a $3-$5 move in oil prices in the short term. The market has been sleep-walking in risk premium in the region, disproportionately focusing on risk to demand growth and shale oil supply." "This attack introduces a New, irreversible risk premium into the market." Expects oil to rise to $80-90 a barrel over the next three-six months as the market turns its focus to geopolitics.

Tilak Doshi, Muse & Stancil

"In the oil universe, this attack is perhaps equivalent to the 9/11 attacks ... Abqaiq is easily the world's single most important oil production and processing infrastructure site." "This puts Iran's wars-by-proxy in the region squarely in The centre of the security concerns of the Middle East." "For Asian governments, perhaps this overtakes the perennial concern about the safety of tanker traffic in the Strait of Hormuz with even more serious concerns about the impact of a direct breakout of hostilities between the Saudi alliance and Iran." "Governments throughout the Asian region will perhaps now be more supportive of the US administration's tough deposition regime on Iran." ("Asian countries are more at immediate risk because they are the big importers from Saudi Arabia, with 80 % of Saudi exports going to East Asia. )

周六被几架无人驾驶飞机袭击在Khuraiss 沙特第二大油田及世界上最大的Abqaiq原油加工厂后,沙特阿美公司每天产量损失约570万桶。这使沙特阿拉伯的原油产量减少了一半,将全球约5%的供应量从市场上撤下。据知情人士透露,恢复正常生产可能需要数周时间。特朗普推文显示可能会与伊朗开战:“沙特阿拉伯的石油供应遭到袭击。 有理由相信我们知道谁是罪魁祸首,目标已被被锁定和装载已准备就绪,只等待验证。等待听到沙特王国关于他们认为是这次袭击的原因与人,以及我们将在什么条件下进行!” 在周日的早期起货交易中,WTI原油价格上涨近6美元/桶。

以下是分析师们的评论:

Rapid McAally,Rapidan Energy:

“今天对Abqaiq加工厂的攻击确定了最重要的油价看涨,股票看跌和全球负面增长风险。据报道,Aramco表示,预计生产将迅速重启,表明损害可能很轻。即使结果是就像这样,例如,伊朗特工对沙特阿拉伯王国能源系统的无耻攻击将增加整体地缘政治风险溢价。“ 在七天的中断情况下,原油价格将飙升至少15-20美元桶,在30天的中断情况下油价会升至三位数。

Greg Newman,Onyx Commodities

布伦特原油期货周一开盘会上涨2美元而收于每桶7美元至10美元。如果问题在短期内无法解决,油价可能会回到每桶100美元。

Christy Malek,JPMorgan Chase

“我预计短期内油价将上升3到5美元间 。这个市场的风险溢价一直在下滑,不成比例地关注需求增长和页岩油供应的风险。 这次袭击给市场带来了新的,不可逆转的风险溢价。随着市场将焦点转向地缘政治,油价预计未来三到六个月将升至每桶80-90美元。”

Tilak Doshi,Muse和Stancil

“在石油世界,这次袭击可能相当于9/11袭击...... Abqaiq是世界上最重要的石油生产和加工基础设施站点。这使伊朗代理战争成为该中东安全问题的核心。对于亚洲各国政府来说,沙特联盟与伊朗之间直接敌对行动更严重的影响可能已经取代了对霍尔木兹海峡油轮运输安全的长期担忧。整个亚洲地区现在可能会更加支持美国政府对伊朗的强硬制裁措施。” (“亚洲国家风险更大因为它们是沙特阿拉伯的主要进口国,沙特阿拉伯80%的出口产品流向东亚。”)

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Friday, September 13, 2019

It May Be Time To Buy This Hedge 或许是时候买这个对冲

The US stock market is bullish as evidenced by capitals coming out of US Treasury and precious metals and going into stocks lately. Positive developments on US/china trade talks and easing monetary policies from US Federal Reserve and the European and Chinese Central Banks also are helping. As major market indexes are ready to make all time high, the 2X fear gauge ETF TVIX is approaching all time low. However, even though US stock market making all time high looks likely but it's not a guarantee. Any unforeseen negative news will usher in market sell off. Today's Apple price target drop by Goldman Sachs is such a risk. At this extreme and critical point of the stock market, it may not be a bad idea to buy some protection. TVIX (13.21) has dropped 45% since its high of 24.11 on August 15. TVIX is a good hedge since it moves big when it reverses.

近期美国国债和贵金属的被抛售而资金进入股市是美国股市看涨的明证。美国联邦储备委员会以及欧洲和中国中央银行推行宽松货币政策及美中贸易谈判方面的积极发展都对美股有帮助。 在主要市场指数正准备创建历史新高之际,2倍恐惧指标ETF TVIX却接近新低。 然而,即使美国股市看起来很有创新高的可能,但这不是一个保证。 任何不可预见的负面消息都会引发市场抛售。 今天高盛下调苹果价格目标便是这种不可预见的风险。 在股市的这个极端和关键点,购买一些保护性对冲可能不是一个坏主意。 TVIX(13.21)自8月15日的高点24.11以来已下跌45%。TVIX是一个很好的对冲,因为它在逆转时会大幅上涨。

近期美国国债和贵金属的被抛售而资金进入股市是美国股市看涨的明证。美国联邦储备委员会以及欧洲和中国中央银行推行宽松货币政策及美中贸易谈判方面的积极发展都对美股有帮助。 在主要市场指数正准备创建历史新高之际,2倍恐惧指标ETF TVIX却接近新低。 然而,即使美国股市看起来很有创新高的可能,但这不是一个保证。 任何不可预见的负面消息都会引发市场抛售。 今天高盛下调苹果价格目标便是这种不可预见的风险。 在股市的这个极端和关键点,购买一些保护性对冲可能不是一个坏主意。 TVIX(13.21)自8月15日的高点24.11以来已下跌45%。TVIX是一个很好的对冲,因为它在逆转时会大幅上涨。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Thursday, September 12, 2019

Stock Market Making All Time High Likely 美股创新高的可能性高

The S&P 500 index is only 10 points 0.3% away from all time high 3027. It is very likely that all time high will be reached imminently. Will it make all time and hold? It sure look like it will base on the fact that hedge securities such as gold, us treasury and volatility index are being sold and the following bullish news are supportive. The bullish Shanghai Composite Index also helps. The following ETFs and stocks may be good candidates to participate for the short term upside of the market: FNGU, AMZN, AAPL, MSFT, ASHR, BABA and JD.

。US/China trade talk to resume in early October in Washington DC. Trade headline going favorably.

。China's central bank announced on Friday that it will cut the required reserve ratio for all 。commercial banks, freeing up long-term funding of around 900 billion yuan (US$126 billion) that banks can use to increase lending and support government efforts to shore up the Real economy.

The 0.50 percentage point cut in the amount of reserves banks are required to hold at the central bank will be effective from September 16, the People's Bank of China (PBOC) said.

。The European Central Bank cut its deposit rate to -0.5% from -0.4% and said it will keep rates low until inflation picks up. It also said it will restart asset purchases in November.

。President Donald Trump delayed planned China tariff hikes on Oct. 1 by two weeks as a "gesture of good will," he tweeted late Wednesday.

。Market expects Fed will lower interest rate by 0.25% next Wednesday.

标准普尔500指数距离历史高点3027只有小于10点(0.3%)的距离。看来达到历史最高点已无可避免。它会达到并且会维持吗?基于黄金,美国国债和波动率指数等对冲证券正在被抛售以及下面的看涨消息都支持下,看起来它会。看涨的上证指数也有帮助。以下的ETF和股票可能是参与短期市场上涨的好方法:FNGU,AMZN,AAPL,MSFT,ASHR,BABA和JD。

。美国/中国贸易谈判于10月初在华盛顿特区恢复。贸易谈判新闻偏好。

。中国央行上周五宣布,将削减所有商业银行的存款准备金率,释放银行可用于增加贷款的资金约9000亿元人民币(1260亿美元)。中国人民银行(PBOC)表示,自9月16日起,银行在中央银行持有的准备金会减少0.50个百分点。

。欧洲央行将存款利率从-0.4%下调至-0.5%,并表示将维持利率在低位直至通胀回暖。它还表示将在11月重启资产购买。

。周三,总统唐纳德特朗普将计划在10月1日开始的中国关税上调延迟了两周作为“善意的举动”。

。市场预期下周三美国联储局将调低利率0.25%。

。US/China trade talk to resume in early October in Washington DC. Trade headline going favorably.

。China's central bank announced on Friday that it will cut the required reserve ratio for all 。commercial banks, freeing up long-term funding of around 900 billion yuan (US$126 billion) that banks can use to increase lending and support government efforts to shore up the Real economy.

The 0.50 percentage point cut in the amount of reserves banks are required to hold at the central bank will be effective from September 16, the People's Bank of China (PBOC) said.

。The European Central Bank cut its deposit rate to -0.5% from -0.4% and said it will keep rates low until inflation picks up. It also said it will restart asset purchases in November.

。President Donald Trump delayed planned China tariff hikes on Oct. 1 by two weeks as a "gesture of good will," he tweeted late Wednesday.

。Market expects Fed will lower interest rate by 0.25% next Wednesday.

标准普尔500指数距离历史高点3027只有小于10点(0.3%)的距离。看来达到历史最高点已无可避免。它会达到并且会维持吗?基于黄金,美国国债和波动率指数等对冲证券正在被抛售以及下面的看涨消息都支持下,看起来它会。看涨的上证指数也有帮助。以下的ETF和股票可能是参与短期市场上涨的好方法:FNGU,AMZN,AAPL,MSFT,ASHR,BABA和JD。

。美国/中国贸易谈判于10月初在华盛顿特区恢复。贸易谈判新闻偏好。

。中国央行上周五宣布,将削减所有商业银行的存款准备金率,释放银行可用于增加贷款的资金约9000亿元人民币(1260亿美元)。中国人民银行(PBOC)表示,自9月16日起,银行在中央银行持有的准备金会减少0.50个百分点。

。欧洲央行将存款利率从-0.4%下调至-0.5%,并表示将维持利率在低位直至通胀回暖。它还表示将在11月重启资产购买。

。周三,总统唐纳德特朗普将计划在10月1日开始的中国关税上调延迟了两周作为“善意的举动”。

。市场预期下周三美国联储局将调低利率0.25%。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Tuesday, September 3, 2019

If Recession Ensues, How Low Can The Nasdaq Go 如果经济衰退,纳斯达克能跌多小

US and China raised tariff against each other's products this past Sunday; US manufacturing PMI reported below 50 and 2 year and 5 year yield inverted; there are more and more talk about recession.

Other recession signals are also starting to appear: S&P 500 earnings estimate slow to 164.53, this is the lowest level since December 2018's 173.21; Economic Policy Uncertainty index hit all time high in June to 342; Q2 gross private domestic investment tumble 5.5%, the worst since Q4 2015. Just how bad the stock market can do if there's a recession? We can use the last 2 recessions as references:

The 2000 to 2002 Dot Com Bubble burst recession, the high tech index Nasdaq Composite dropped 78% and the 2007 to 2009 Subprime Mortgage Crisis and the ensuing collapse of the US housing bubble burst recession , the same index dropped 56%. The average Nasdaq Composite drop is 67% during the last two recessions. Assuming the coming recession only drop the Nasdaq Composite by 50%, the index may drop to 4200! Don't ignore this comparison. Global economy has too much risk and on verge of recession, it doesn't make sense that the Nasdaq composite is only below its all time high level by 5.6%. 50% down from all time high may be aggressive but 10 to 20% down is very reasonable. For 10% and 20% down, the Nasdaq Composite level would be 7506 and 6672 respectively. Following are today's market news and analyst comments:

。Tariffs on $112 billion of Chinese goods kicked in on Sunday. This round of duties target many everyday grocery items and household staples, which could cost the average American household $1,000 a year, J.P. Morgan estimated.

。The manufacturing ISM manufacturing index PMI was at 49.1% in August, down from 51.2% in July. The employment index was at 47.4%, down from 51.7% last Month, and the new orders index was at 47.2% , down from 50.8%. They are all below 50% indicating economic contraction.

。UBS' chief economist Seth Carpenter eyes the Trump admin' latest trade war round which includes an additional 5% of tariffs on previously announced or enacted tariffs, and claiming that "tariffs have taken a heavy toll and the latest escalation is substantial" . UBS forecasts real GDP Growth to be about 1.8% in, a modest deceleration from the growth in Q3, but still about in line with the Fed's estimate of potential growth. Things, however, get ugly fast in 2020, when the Swiss Bank now expects GDP to slow notably To 0.5% in Q1 and decelerates further to 0.3% in Q2.

。Morgan Stanley’s Chief Market Strategist Mike Wilson, one of Wall Street’s most skeptical strategists, is advising clients to dump growth stocks and buy defensive names, saying “demand destructive” tariffs are fanning recession fears.

。According to Peter Schiff, the chief global strategist at Euro Pacific Capital, it was a "huge mistake" for the Federal Reserve to cut interest rates last month. Schiff says there is no way for the Federal Reserve to stops the United States from going into a recession. According to Schiff, it's impossible to build a viable economy on the back of artificially low interest rates. "All it accomplishes it to push up asset prices, creating bubbles and malinvestments that hurt the economy. Relying on low interest rates for growth Make it certain that recessions will ensue when monetary policy tightens,” he added.

美国和中国在上周日对彼此的产品征收关税;美国制造业PMI报告低于50和2年及5年国债回报率倒挂;经济衰退之声越来越响亮。 其他衰退信号也开始出现:标准普尔500指数盈利预估放缓至164.53,这是自2018年12月的173.21以来的最低水平;经济政策不确定性指数在6月创下历史新高至342; 第二季度国内私人投资总额下跌5.5%,为2015年第四季度以来的最低水平。如果出现经济衰退,股市有多糟糕?我们可以使用最后两次经济衰退作为参考:2000年至2002年的互联网泡沫破裂导致萧条,高科技指数纳斯达克综合指数下跌了78%,而2007年至2009年的次级抵押贷款危机以及随后美国房地产泡沫破裂的崩溃,同样的指数下跌了56%。在过去两次经济衰退期间,纳斯达克综合指数的平均跌幅为67%。假设即将到来的经济衰退只使纳斯达克综合指数下跌50%,该指数可能跌至4200!不要忽视这样的比较。 在全球经济濒临衰退的风险大的情况下,纳斯达克综合指数仅低于历史最高水平5.6%是不合理的。 从历史最高点下跌50%可能是激进点,但下跌10%至20%是非常合理的。纳斯达克综合指数下跌10%和20%的水平分别为7506和6672。下面是今天的市场消息与分析师评论:

。周日,有1120亿美元的中国商品关税开始征收。 J.P. Morgan估计,这一轮关税针对的是许多日常杂货和家庭主食,这可能使美国家庭平均每年花费多1000美元。

。8月制造业ISM制造业指数PMI为49.1%,低于7月份的51.2%。就业指数为47.4%,低于上月的51.7%,新订单指数为47.2%,低于50.8%。他们都低于50%显示经济萎缩。

。瑞银的首席经济学家赛斯卡彭特Seth Carpenter关注特朗普管理层的最新一轮贸易战,其中包括对先前宣布或颁布的关税增加额外5%的关税,并声称“关税已经造成重大损失,最近的升级是实质性的”。瑞银预计实际GDP增长率约为1.8%,与第三季度的增长相比略有减速,但仍与美联储对潜在增长的预测一致。然而,在2020年事情将变得非常丑陋,瑞士银行预计GDP将明显放缓至第一季度的0.5%,并在第二季度进一步减速至0.3%。

。摩根士丹利的首席市场策略师迈克威尔逊Mike Wilson是华尔街最持怀疑态度的策略家之一,他建议客户抛售增长股并购买防预性股票,称“需求破坏性”关税正在煽动经济衰退的担忧。

。据欧洲太平洋资本(Global Pacific Capital)首席全球策略师彼得•席夫(Peter Schiff)称,上个月美联储降息是一个“巨大的错误”。席夫说,美联储无法阻止美国陷入衰退。 Schiff认为,在人为的低利率背景下建立一个可行的经济是不可能的。 “所有这一切都只是推高资产价格,制造泡沫和损害经济的不良投资。依靠低利率促进增长确保货币政策收紧时会出现经济衰退,”他补充道。

Other recession signals are also starting to appear: S&P 500 earnings estimate slow to 164.53, this is the lowest level since December 2018's 173.21; Economic Policy Uncertainty index hit all time high in June to 342; Q2 gross private domestic investment tumble 5.5%, the worst since Q4 2015. Just how bad the stock market can do if there's a recession? We can use the last 2 recessions as references:

The 2000 to 2002 Dot Com Bubble burst recession, the high tech index Nasdaq Composite dropped 78% and the 2007 to 2009 Subprime Mortgage Crisis and the ensuing collapse of the US housing bubble burst recession , the same index dropped 56%. The average Nasdaq Composite drop is 67% during the last two recessions. Assuming the coming recession only drop the Nasdaq Composite by 50%, the index may drop to 4200! Don't ignore this comparison. Global economy has too much risk and on verge of recession, it doesn't make sense that the Nasdaq composite is only below its all time high level by 5.6%. 50% down from all time high may be aggressive but 10 to 20% down is very reasonable. For 10% and 20% down, the Nasdaq Composite level would be 7506 and 6672 respectively. Following are today's market news and analyst comments:

。Tariffs on $112 billion of Chinese goods kicked in on Sunday. This round of duties target many everyday grocery items and household staples, which could cost the average American household $1,000 a year, J.P. Morgan estimated.

。The manufacturing ISM manufacturing index PMI was at 49.1% in August, down from 51.2% in July. The employment index was at 47.4%, down from 51.7% last Month, and the new orders index was at 47.2% , down from 50.8%. They are all below 50% indicating economic contraction.

。UBS' chief economist Seth Carpenter eyes the Trump admin' latest trade war round which includes an additional 5% of tariffs on previously announced or enacted tariffs, and claiming that "tariffs have taken a heavy toll and the latest escalation is substantial" . UBS forecasts real GDP Growth to be about 1.8% in, a modest deceleration from the growth in Q3, but still about in line with the Fed's estimate of potential growth. Things, however, get ugly fast in 2020, when the Swiss Bank now expects GDP to slow notably To 0.5% in Q1 and decelerates further to 0.3% in Q2.

。Morgan Stanley’s Chief Market Strategist Mike Wilson, one of Wall Street’s most skeptical strategists, is advising clients to dump growth stocks and buy defensive names, saying “demand destructive” tariffs are fanning recession fears.

。According to Peter Schiff, the chief global strategist at Euro Pacific Capital, it was a "huge mistake" for the Federal Reserve to cut interest rates last month. Schiff says there is no way for the Federal Reserve to stops the United States from going into a recession. According to Schiff, it's impossible to build a viable economy on the back of artificially low interest rates. "All it accomplishes it to push up asset prices, creating bubbles and malinvestments that hurt the economy. Relying on low interest rates for growth Make it certain that recessions will ensue when monetary policy tightens,” he added.

美国和中国在上周日对彼此的产品征收关税;美国制造业PMI报告低于50和2年及5年国债回报率倒挂;经济衰退之声越来越响亮。 其他衰退信号也开始出现:标准普尔500指数盈利预估放缓至164.53,这是自2018年12月的173.21以来的最低水平;经济政策不确定性指数在6月创下历史新高至342; 第二季度国内私人投资总额下跌5.5%,为2015年第四季度以来的最低水平。如果出现经济衰退,股市有多糟糕?我们可以使用最后两次经济衰退作为参考:2000年至2002年的互联网泡沫破裂导致萧条,高科技指数纳斯达克综合指数下跌了78%,而2007年至2009年的次级抵押贷款危机以及随后美国房地产泡沫破裂的崩溃,同样的指数下跌了56%。在过去两次经济衰退期间,纳斯达克综合指数的平均跌幅为67%。假设即将到来的经济衰退只使纳斯达克综合指数下跌50%,该指数可能跌至4200!不要忽视这样的比较。 在全球经济濒临衰退的风险大的情况下,纳斯达克综合指数仅低于历史最高水平5.6%是不合理的。 从历史最高点下跌50%可能是激进点,但下跌10%至20%是非常合理的。纳斯达克综合指数下跌10%和20%的水平分别为7506和6672。下面是今天的市场消息与分析师评论:

。周日,有1120亿美元的中国商品关税开始征收。 J.P. Morgan估计,这一轮关税针对的是许多日常杂货和家庭主食,这可能使美国家庭平均每年花费多1000美元。

。8月制造业ISM制造业指数PMI为49.1%,低于7月份的51.2%。就业指数为47.4%,低于上月的51.7%,新订单指数为47.2%,低于50.8%。他们都低于50%显示经济萎缩。

。瑞银的首席经济学家赛斯卡彭特Seth Carpenter关注特朗普管理层的最新一轮贸易战,其中包括对先前宣布或颁布的关税增加额外5%的关税,并声称“关税已经造成重大损失,最近的升级是实质性的”。瑞银预计实际GDP增长率约为1.8%,与第三季度的增长相比略有减速,但仍与美联储对潜在增长的预测一致。然而,在2020年事情将变得非常丑陋,瑞士银行预计GDP将明显放缓至第一季度的0.5%,并在第二季度进一步减速至0.3%。

。摩根士丹利的首席市场策略师迈克威尔逊Mike Wilson是华尔街最持怀疑态度的策略家之一,他建议客户抛售增长股并购买防预性股票,称“需求破坏性”关税正在煽动经济衰退的担忧。

。据欧洲太平洋资本(Global Pacific Capital)首席全球策略师彼得•席夫(Peter Schiff)称,上个月美联储降息是一个“巨大的错误”。席夫说,美联储无法阻止美国陷入衰退。 Schiff认为,在人为的低利率背景下建立一个可行的经济是不可能的。 “所有这一切都只是推高资产价格,制造泡沫和损害经济的不良投资。依靠低利率促进增长确保货币政策收紧时会出现经济衰退,”他补充道。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Contact Email: tradeideablog@gmail.com

U.C. Berkeley graduated, former electronic/computer engineer turned investment advisor / analyst. In the market 42 years with focus in market timing, learned from experience to trust charts,combine with trend, valuation, news and investors sentiment in making trading decisions,, knowing anything can happen to the market so very flexible to trade both sides of the market. 1992 CNBC/USA Today Investment Challenge professional options division champ with 3 month return of 1125%. In real life trading accomplished 9600% return by trading TZA options in the course of 3 months, doubled account value in 3 months by trading 3X ETFs. Now retired and enjoy trading stock and options daily. On going partnership with Sing Tao Daily and Sing Tao Radios in offering advanced stock and options trading classes semi-annually.

联系Email:tradeideablog@gmail.com

伯克利加州大学毕业,前电子/计算机工程师转为财务顾问/股市分析师。 在市场42年,专注于参与市场时机。从经验中学到信任图表,结合趋势、估值、新闻和投资者情绪做出交易决策。知道任何事情都可能发生在市场上,因此非常灵活地参与买涨及做空,参与市场的两个方向。 1992年CNBC /今日美国日报投资挑战赛专业期权组冠军,3个月回报率为1125%。 在现实生活中,通过在3个月内交易TZA期权获得9600%的回报,通过交易3X ETF在3个月内使账户价值翻倍。 现在退休,享受每日交易股票和期权。 与星岛日报和星岛电台合作,每半年提供一次深入的股票和期权交易课程。

Subscribe to:

Posts (Atom)