Major US stock dropped sharply today with the Dow, S&P500, Nasdaq Composite and Russell 2000 dropping 569.38 (-1.63%), 90.48 (-2.04%), 423.29(-2.83%) and 50.06 (-2.19%) respectively. The reasons for the sharp pull back are rising treasury yields, rising oil prices and weakness in Asian and European markets. The worrying part of today's market action is major indexes are all closed near today's lows. There were buy-on-dips during the trading day, but sell on rallies have been pushing the market back down. Another bad thing for the market is all major market indexes are now below their critical 50 day moving averages and this is a severe technical damage for the market. The market is now having sell signal and follow through to the downside is likely. A confluence of negative fundamental events are also appearing which are raising concerns, they are:

1. Federal Reserve believes situations are ripe for reducing bond purchasing. Markets are starting to reflect Fed tapering. US Treasuries have been down 4 days in a row ( treasury yields have been up the last 4 days). Deutsche Bank analyst Jim Reid believes we are now entering the most aggressively global hiking cycle in a decade. Investors have been following the Wall Street moto of don't fight the Fed and have been buying stocks as Fed apply easy monetary policy. When the Fed starts to tighten, should investors follow the moto by selling stocks?

2. The Chineses government have been clamping down on industries with increased regulations on high techs, real estate, gaming, education etc.in the last few months. These have the effect of weakening its economic growth. Analysts have been lowering estimates for Chinese GDP. Goldman Sachs lowers Q3 Chinese GDP growth from previous estimate of 1.3% to 0. The weakening growth of the world's 2nd largest economy definitely will drag the global economy with it.

3. The global energy crunch has been pushing oil price up. US crude oil price moved from August low of 61.82 to today's high of 76.67, a rise of 24% in just a little over a months time. Energy crunch in China is causing factories closing and the result is component shortage. The rise of oil price, higher component prices due to supply chain disruption together with higher cost of labor all point to higher inflation. Higher inflation together with lower growth is stagflation and is not easy to fix.

4. According to Data Trek Research, Q3 earnings estimate for the S&P 500 has been falling. Weaker earning reports going up are not going to be good for stocks.

5. The trailing 12 month PE for the S&P 500 is now at 33.95 and is the 3rd highest in history. It is also much higher than the historic median of only 14.86. The Buffet Indicator is now at 239% and is higher than the historical average by 91%. Stocks have been way over value. Up to August 21,2021, total margin debt is $911,545,000,000, highest in history. This makes the stock market very risky.

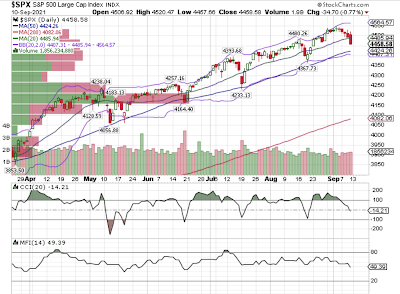

Based on the above observations, I think the US stock market will likely have a bigger correction. I don't know when will the correction end, a 10% down from all time high is a good start. Looking at the S&P 500 chart, it gapped below its 50 day moving average at 4444 with a lot of downside momentum. This is a sell signal. Indicator CCI dropped below -100 level is another sell signal. A trip down to its 200 day moving average 4128 looks likely and is 9.2% down from all time high level of 4546.

今日美股大跌,道指、标普 500、纳斯达克综合指数和罗素 2000 指数分别下跌 569.38(-1.63%)、90.48(-2.04%)、423.29(-2.83%)和 50.06(-2.19%)。大幅回落的部份原因是国债收益率上升、油价上涨以及亚洲和欧洲市场疲软。今天市场走势令人担忧的是主要股指均收于今天的低点附近。今日有逢低买入,但随之而来的是逢高卖出一直在推动市场回落。对市场来说另一件坏事是所有主要市场指数现在都低于它们关键的 50 天移动平均线,这对市场来说是一个严重的技术损害。市场现在有卖出信号,继续下行的可能性大。一系列负面的基本面情况也正在出现而引起了人们的关注,它们是:

1. 美联储认为减少债券购买的时机已经成熟。市场正开始反映美联储的缩减。美国国债连续 4 天下跌(过去 4 天国债收益率都上升)。德意志银行分析师吉姆·里德认为,我们现在正在进入十年来最激进的全球加息周期。投资者一直遵循华尔街的“不与美联储对抗”的策略,并随着美联储宽松的货币政策而购买股票。当美联储开始收紧政策时,投资者是否应该通过抛售股票来实行“不与美联储对抗”呢?

2. 过去几个月,中国政府对高科技、房地产、游戏、教育等行业加大了监管力度。这些都会削弱其经济增长。分析师们都在下调对中国 GDP 的估计。高盛将第三季度中国GDP增速从此前预估的1.3%下调至0增长。当世界第二大经济体增速放缓时势必会拖累全球经济。

3. 全球能源危机推高油价。美国原油价格从 8 月的低点 61.82 升至今天的高点 76.67,在短短一个多月的时间里上涨了 24%。中国的能源紧缩导致工厂关闭,结果是导致零部件短缺。油价上涨、供应链中断导致的零部件价格上涨以及劳动力成本上涨都显示通货膨胀率上升。高通货膨胀加上较低的增长是滞胀,这个问题不容易解决。

4. 根据 Data Trek Research 的数据,标准普尔 500 指数第三季度的盈利预测一直在被调低。疲软的盈利报告将对股市不利。

5. 标准普尔 500 指数过去 12 个月的市盈率为 33.95,是历史第三高。它也远高于仅 14.86 的历史中位数。 巴菲特指标现在为 239%,比历史平均水平高 91%。股票已经是大大超值。截至 2021 年 8 月 21 日,保证金债务总额为 911,545,000,000 美元,创历史新高。这使得股市越发危险。

基于以上观察,我认为美国股市很可能会有更大的下跌调整。 我不知道修正什么时候会结束,从历史最高点下跌 10% 是一个合适的开始。从标准普尔 500 指数图表来看,它跳空低于50天移动平均线4444 水平,具有很大的下行动力。 这本身是个卖出信号。 指标 CCI 跌破 -100 水平是另一个卖出信号。 它很有可能跌至 200 天移动平均线 4128,这是从历史高位 4546 下跌 9.2%。