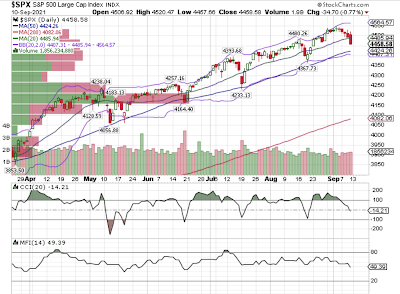

Many signs point to US stock market correction may have begun. Seasonally, September is the worst performing month for stocks since 1985. Technically, the large cap Dow Jones Industrial Average ($INDU 34607.72 -0.78%), the broad New York Stock Exchange Composite ($NYA 99.64-0.60%) and the small cap Russell 2000 ETF (IWM 221.62-0.98%) have all dipped below their important 50 day moving averages. In addition, weakness in tech leaders such as AAPL(148.97 -3.31%), TSLA (736.27 -2.46%) and GOOG (2838.42 -2.07%) are leading the tech sector (XLK 156.63 -0.99%) down. Fundamentally, according to the latest articles from ZeroHedge's "5 Divergences In The Stock Market To Keep An Eye On This Fall" and "10 points on why investors are bearish for the last two weeks of September" and Seeking Alpha top author Lance Roberts's "Investors Hold Record Allocations Despite Rising Warnings", a deeper stock market correction of 5 to 10% seem unavoidable.

By experience and historic fact the quickest way to rip profit during market drop is none other than buying UVXY (23.86+5.53%), the ProShare Ultra VIX Short-Term Futures ETF. During the course of 2021 so far there were 4 notable S&P 500 dips, they are January 21 to January 27 (-3.9%), May 7 to May 12 (-5.7%), July 16 to July 19 (-3.3%) and August 16 to August 19 (-2.5%). During these market dips, UVXY were up 54%, 57%, 46% and 27% respectively. As a result, the average move ratio between UVXY and S&P 500 is 12.97. This means each 1% drop in S&P 500, the UVXY increases by 12.97%. If we project the S&P 500 will correct down 10% from all time high, there is approximately 8.3% left to drop from Friday's close of 4458.58 and the downside target is 200 day moving average at 4080 level. This means UVXY will rise 12.97x8.3%=107.65% from Friday's close of 23.86 and the projected UVXY target hence is 23.86+23.86x107.65%=49.55.

Author note:I own UVXY call options.

很多迹象都显示美国股市可能已经开始调整。就季节性而言,9 月是 1985 年以来股市表现最差的月份。从技术上讲,大盘股道琼斯工业平均指数($INDU 34607.72 -0.78%)、广泛的纽约证券交易所综合指数 ($NYA 99.64-0.60%) 盘股罗素 2000 指数ETF (IWM 221.62-0.98%) 都跌破了重要的 50 天移动平均线。此外,AAPL(148.97 -3.31%)、TSLA (736.27 -2.46%) 和 GOOG (2838.42 -2.07%) 等科技龙头股的疲软带领科技股 (XLK 156.63 -0.99%) 下跌。从基本面上看,根据 ZeroHedge 的“今年秋天要密切关注的股票市场的 5 个背离”和“为什么投资者在 9 月的最后两周看空的10个原因 ”以及 Seeking Alpha 顶级作者 Lance Roberts 的“尽管警告不断增加,但投资者仍保持创纪录的股票分配”,这些都显示5% 至 10% 的更深层次的股市回调似乎是不可避免的。

根据经验和历史事实,在市场下跌期间赚取利润的最快方法就是购买 ProShare Ultra VIX 短期期货 ETF UVXY (23.86+5.53%)。 2021 年到目前为止,标准普尔 500 指数有 4 次显着回调,分别是 1 月 21 日至 1 月 27 日(-3.9%)、5 月 7 日至 5 月 12 日(-5.7%)、7 月 16 日至 7 月 19 日(-3.3%)和8 月 16 日至 8 月 19 日(-2.5%)。在这些市场下跌期间,UVXY 分别上涨了 54%、57%、46% 和 27%。以此来算UVXY 和标准普尔 500 指数之间的波幅平均比率为 12.97倍。这意味着标准普尔 500 指数每下跌 1%,UVXY 就会增加 12.97%。如果我们预计标准普尔 500 指数将从历史高点回调 10%,那么距离周五收盘价 4458.58 还剩下大约 8.3%,下行目标是200 天移动平均线4080 水平 。这意味着 UVXY 将从周五收盘价 23.86 上涨 12.97x8.3%=107.65%,因此预计 UVXY 目标是 23.86+23.86x107.65%=49.55。

作者注:我拥有 UVXY 看涨期权。

GOAT!

ReplyDelete