US public health officials on the west coast warned that the recent cases in California and Washington State are evidence that community outbreaks have already begun in Northern California, Oregon and Washington State.

In the world, confirmed COVID-19 confirmed infection cases has now reached 85966 confirmed and 2941 death. Inside China there are 79251 confirmed and 2835 deaths. Outside China there are 6715 confirmed and 106 deaths. The virus has spread to all continents except Antarctica, 62 countries.The outbreaks were particularly severe in South Korea, Italy and Iran. Besides Asia, the epidemic is most severe in Europe and the Middle East.

Chinese Economy:

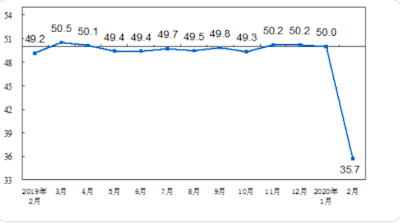

China's official manufacturing PMI in February was 35.7, worse than the lowest reached previously during the global financial crisis during 2008-2009 when the PMI was in the range of 38.8 - 45.3, and it is the worst in history since the data has been compiled. The non-manufacturing gauge also fell to its lowest ever, 29.6. Both were well below 50, which denotes contraction. The economic fallout from the deadly coronavirus may cause a 6% contraction in China’s first-quarter gross domestic product, according to Pacific Investment Management Co.

The GDP contraction, which would be at a quarterly annualized rate, would push down year-on-year growth to 3%, compared with 6% expansion last year, according to Nicola Mai, a portfolio manager and head of sovereign credit research in Europe, and Tiffany Wilding, a U.S. economist.The impact of this will be felt around the globe as China accounts for a quarter of worldwide manufacturing activity, they said.

Global Economy:

The COVID-19 spread is putting the global economy at the greatest risk of recession since the 2008 financial crisis. "With the partial exception of the Black Death in 14th century Europe, every major pandemic has been followed by an economic recession," said Professor Robert Dingwall, researcher at the University of Nottingham Trent in England. "I don't think there is any good reason to think it would be different this time." Goldman Sachs Group Inc. economists who said in a report Friday that global GDP will shrink on a quarterly basis in the first two quarters of this year before rebounding in the second half.

Rescue Hopes:

After the Dow shed 3600 points with four 1000 point range day, previously bullish Thomas Lee, founder of Fundstrat Global Advisors, acknowledges that something isn’t right with a market that was just enjoying a record close days ago. He wouldn’t be surprised if the government kicks in surprise plans to help stanch the bleeding in markets. Those might include:

。A health-care action plan

。 An announcement of financial support by the Treasury Department

。Other fiscal stimulus packages

。An emergency interest-rate cut by the Fed

The US Stock Market:

Since February 19, the Dow, S&P 500 and Nasdaq Composite tumbled 16.5%, 15.8% and 14.3% respectively from all time highs to February 28 lows. All major market indexes dropped below their 20, 50, 100 and 200 day moving averages and their short, intermediate and long term trends are now all down. An economy recession and a stock market bear market may ensue if the coronavirus spread is not under control soon. It is going to take a long time for investors to rebuilt confidence on the stock market. Even though the extreme fear and hope of rescue plans from the government may cause the market to bounce in the short term, but the bounce may be short lived. The strategy for a down trending market is sell on rallies (when market bounce to resistance).

最新的COVID-19病毒统计:

美国西海岸的公共卫生官员警告说,加州j及华盛顿洲最近的几宗病例显示病毒已经在北加州,俄勒冈州和华盛顿州社区暴发。

全世界已确认的COVID-19确诊感染病例现已达到确诊85966例死亡和2941例。在中国国内,有79251例确诊和2835例死亡。在中国境外有6715例确诊病例和106例死亡病例。该病毒已传播到南极洲以外的所有大洲及62个国家。韩国,意大利及伊朗疫情尤为严重。除了亚洲外,欧洲及中东地区疫情最为严重。

中国经济:

中国2月份的官方制造业PMI为35.7,低于2008-2009年全球金融危机期间的最低水平,当时PMI在38.8-45.3之间,是有史以来最差的数据。非制造业PMI也跌至历史最低点29.6。两者均远低于50,显示收缩。据太平洋投资管理公司(Pacific Investment Management Co.)称,致命性冠状病毒造成的经济影响可能导致中国第一季度国内生产总值(GDP)萎缩6%。

欧洲投资组合经理兼欧洲主权信用研究主管尼古拉·迈伊(Nicola Mai)表示,GDP收缩按季度年率计算,将使同比增长率降至3%,而去年的增长率为6%。他们说,这种影响将在全球范围内感受到,因为中国占全球制造业活动的四分之一。

全球经济:

自2008年金融危机以来,COVID-19的传播使全球经济处于最大的衰退风险中。英格兰诺丁汉特伦特大学研究员罗伯特·丁沃尔(Robert Dingwall)教授说:“除了14世纪欧洲的“黑死病”部分例外外,每一次大流行都伴随着经济衰退。 “我认为没有充分的理由认为这次会有所不同。”高盛集团(Goldman Sachs Group Inc.)的经济学家周五在一份报告中表示,全球GDP将在今年前两个季度按季度收缩,然后在下半年反弹。

救援希望:

道琼斯指数在四个交易日内下跌3600点后,之前看涨的Fundstrat Global Advisors创始人托马斯·李(Thomas Lee)承认,在不久前市场才刚刚创纪录看来,有些事情是不妥的。如果政府采取出人意料的计划来帮助遏制市场的流血,他不会感到惊讶。这些可能包括:

。保健行动计划

。财政部宣布提供财政支持

。其他财政刺激方案

。美联储紧急降息

美国股票市场:

自2月19日以来,道指,标普500和纳斯达克综合指数分别从历史高点至2月28日低点分别下跌了16.5%,15.8%和14.3%。所有主要市场指数均跌破20、50、100和200日移动平均线,它们短期,中期和长期趋势现已全部下跌。如果不尽快控制冠状病毒的传播,可能会导致经济衰退以至股市熊市。投资者需要很长时间才能重新建立起对股市的信心。尽管对政府救助计划的希望及极端恐惧可能会导致市场在短期内反弹,但这种反弹极可能是短暂的。下跌趋势的策略是逢高卖出(当市场反弹到阻力价位时)。

No comments:

Post a Comment